top of page

Search

FINANCIAL STATEMENT AUDIT – WHAT BUSINESSES NEED TO KNOW

Starting from the 2025 financial year, under the revised Law on Independent Audit and Decree 90/2025/NĐ-CP, the scope of entities required to conduct financial statement audits has been significantly expanded. In addition to the traditional entities such as FDI enterprises, credit institutions, public companies, securities issuers, securities trading organizations, and units utilizing state budget funds, the new regulation now includes large-scale enterprises as part of the m

DECREE NO. 90/2025/ND-CP AMENDING AND SUPPLEMENTING ANUMBER OF ARTICLES OF DECREE NO. 17/2012/ND-CP OF A NUMBER OF ARTICLES OF THE LAW ONINDEPENDENT AUDIT.

Article 1. Amendments and supplements to a number of points and clauses of Article 15 of Decree No.17/2012/ND-CP are as follows: 1. Add...

What is a consolidated financial statement? How it differs from a separate financial statement

In the context of economic integration and the diverse growth of corporate groups, financial statements play a crucial role in providing...

Common Mistakes in Transfer Pricing and How to Address Them Effectively

In the context of global economic integration, transfer pricing transactions between enterprises have become increasingly complex and are...

Reciprocal Tariffs Newletter_RSM Vietnam

In the early morning of April 3, 2025, U.S. President Donald Trump officially announced the United States' reciprocal tariff policy on...

Analysis of the Impact of Transfer Pricing Regulations on SMEs: Opportunities and Challenges in the Context of the New Legal Framework.

In the context of global economic integration, transfer pricing regulations are increasingly being updated and refined to ensure...

December News Summary

DECREE 180/2024/ND-CP: REDUCTION OF 2% VAT FROM 01/01/2025 TO 30/06/2025 To maintain the objective of supporting taxpayers during...

Officially approved the amended Value Added Tax Law

On 26 November 2024, the National Assembly officially passed the Value Added Tax (VAT) Law No. 48/2024/QH15. Compared to the current...

Allowances are not subject to personal income tax in 2024

In 2024, which are the allowances that are not subject to personal income tax? Below are these allowances and subsidies that you need to...

Conditions for the social insurance withdrawal for foreign employees from 01/07/2025

According to Clause 2, Article 70 of the Law on Social Insurance (effective from 1 July 2025), foreign employees are entitled to one-time...

Regulations on CIT incentives for new investment projects in 2024

What does the current regulation stipulate about corporate income tax incentives for new investment projects? See the infographic below...

Increase basic salaries by 30% and minimum salaries by 6% from July 2024

At the end of June 2024, the Government issued Decree 73/2024/ND-CP concerning the new basic salary and Decree 74/2024/ND-CP regarding...

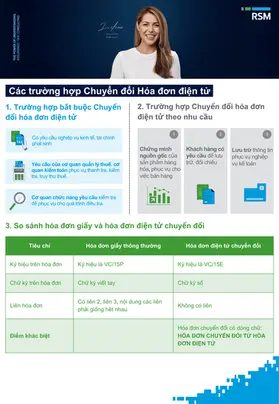

Cases of converting electronic invoices

Converting electronic invoices is convenient for storing business accounting documents as well as performing operations in accordance...

Logistics predictions in 2024

Significant changes will occur in logistics and commerce in 2024. As a result, it is crucial to prepare for these transformations and

Generative AI: transforming Audit, Tax and Accounting in all industries

Generative AI is a type of artificial intelligence that does not limit itself to analysing and processing data but creates and generates new

Why people are at the heart of digital transformation

For as much as a cultural shift is a challenge, it can also be a highly beneficial opportunity

M&A trends in the TMT industry

The dynamics of the Technology, Media, and Telecoms (TMT) industry allow it to stand out from other sectors despite challenging global..

Beyond the grid: The future of automotive innovation

While many of these issues continue to linger, the electric vehicle (EV) revolution is at the epicentre of this excitement

M&A trends in the consumer products sector

Despite encountering challenges, the consumer products sector is renowned for its adaptability

How can SMEs Implement a successful ESG strategy

To improve accountability for non-listed companies, the newly established Sustainability Reporting Advisory Committee set up by ACRA and SGX

bottom of page